I have seen people in private job envy people in government jobs just because they get to earn handsome pension post-retirement. However, being in a private job shouldn’t restrict you from enjoying a handsome pension. All you need is to save just 2000/- per month to get a pension of 25,000/- per month post your retirement. You just need to use SIP + SWP wisely to achieve the same.

Let’s divide this plan into two phases.

SIP or the accumulation phase: In this phase, you just need to invest 2000/- per month for 30 years. I assume you start working at 25 then you need to save till 55. If you start a bit early maybe from pocket money you can start enjoying the pension bit earlier. Well even at 55 when you might be earning in lakhs you just need to save 2000/- per month only.

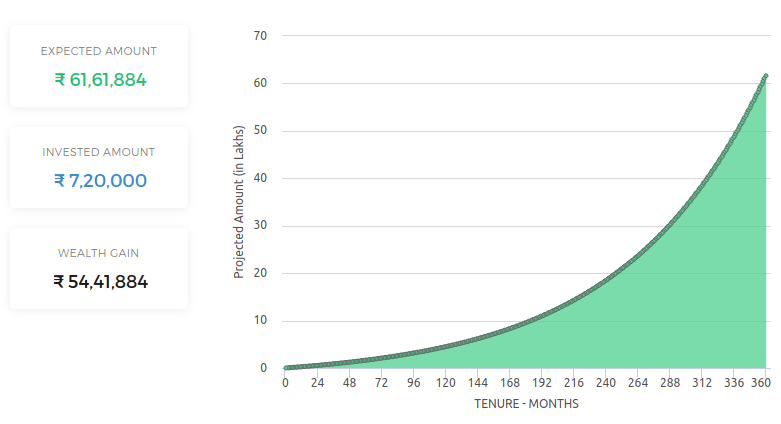

Let’s see how your money will grow in 30 years.

This calculation is based on an estimate that you might get around 12% returns. Even if you assume around 11% returns you will get above 50 lakhs in 30 years.

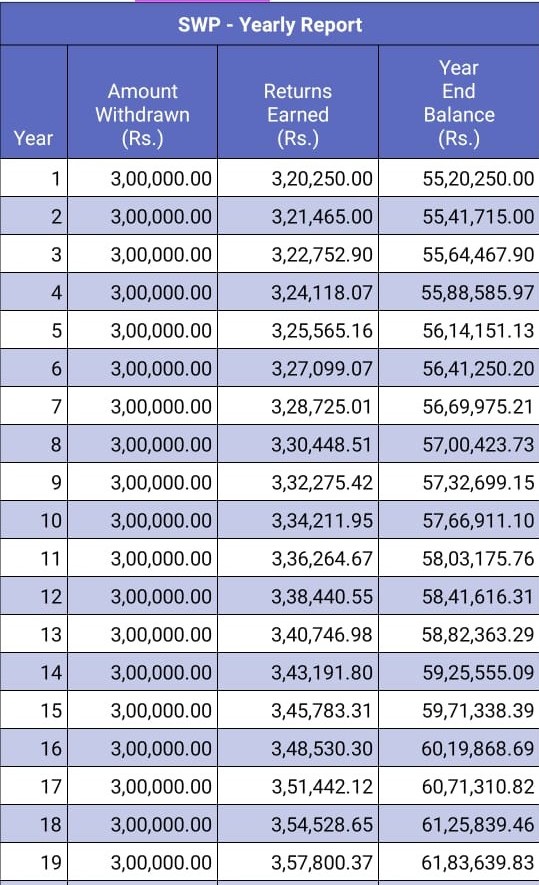

SWP or Annuitization Phase : In this phase you actually start getting the annuity or a monthly income. Here the invested amount needs to be transferred to a combination of liquid + conservative hybrid to generate returns. Speak to your mutual fund advisor. We are assuming a return of around 6% which will keep you giving regular income without touching your corpus.

The above image shows that you are trying to withdraw 25,000 per month or 3lakhs per annum from a corpus of 55lakhs which is our returns. Yes, I have taken 55lakhs instead of 61 lakhs which is our actual returns to be more on the safer side. You can see that we are withdrawing amount lesser than the interest generated. This is to ensure we never run out of our corpus even in the bear run of the stock market.

If you think 25,000 pm is too low then all you need is to double your savings from 2000 p.m. to 4000p.m. and you’ll get 50,000 p.m after 30 years. If this is still low double again until it meets your needs. Do you know that unlike normal pension schemes there is no paperwork to be done like submitting life certificate or any other nonsenses. Also, the returns keep coming, not restricted to you and your spouse only but also to your kids and then their kids. 🙂

Contact your financial advisor to draw out this plan for you and enjoy life both pre and post-retirement.

Leave a Reply