Albert Einstein has rightly said, “Compound interest is the eighth wonder of the world. He who understands it earns it… he who doesn’t… pays it.” The problem is people don’t understand the value of this statement.

My take: Compound interest is the 8th wonder in the world that can help you visit the remaining 7 wonders.

The following blog is related to communication with one of my teammates that happened around 2-3 years back. I recount one day she came to me and said that in the weekend she happened to go to her bank and the executive there were insisting on selling a plan that by just investing few thousands would turn into crores. She said to me that she quickly finished her work in the bank and escaped thinking its some fraudulent plan. I tried to explain that it is not misselling and it is possible. Anyways, I was not able to convince her that day. She refused to accept that the returns generated would at a time exceed the amount invested.

We work our entire life to earn and save money. But it doesn’t serve any purpose if the saved money doesn’t work for us. People still find it weird when I say the saved money should work for us and earn more money.

Just a 6000 per month invested for 25 years would grow to over 1 Crore compounding at 12% p.a… Yes, it’s very difficult to believe. I have tried to explain this logic to many but they don’t understand it’s easily possible.

First-year you’ll invest 6000 x 12 = 72,000 + an interest of 4680. This everyone believes as interest generated is less than the invested amount.

It’s okay for the next 5-6 years also. However, when I try to show the projection of the next 20-25 years they won’t agree to that.

As invested amount over 25 years will be just 18lakhs but interest returned is about 82lakhs.

Time Factor :

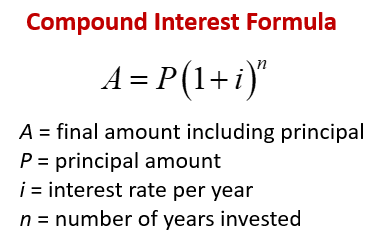

The formula of compound interest is

The most important factor is n which determines the number of years you are invested for. n is so important here because it’s on the exponential part. With the increase in time, your saved money grows exponentially. It’s less about how much you have saved but more about how long you have saved. This is why I always advise people to save in the initial years of your life.

Let’s see with the help of an example:

Suppose X saves 5000 p.m. for 30 years he would make 1.5Crore.

However, if Y saves 10,000 p.m. for 15 years he would make 47 lakh.

The amount invested in both cases will be 18lakhs only. But X accumulates 3 times more than Y.

Compound interest isn’t for the Rich. It’s for the poor who can wait with patience and make money. It’s not for the rich who wants to make some quick money in a year or so. It’s for the poor who wants to be rich and can wait that extra 20-25 years.

Leave a Reply