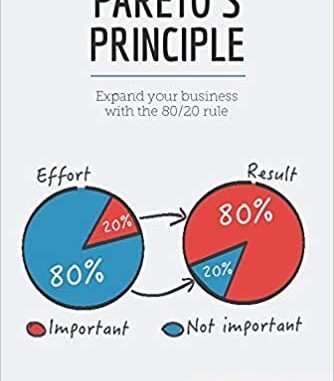

Pareto principle or the 80-20 rule is a much larger rule that applies over a large variety of things. It states that 80% of the effect comes from 20% of the causes. Its application is in almost all fields. In economics, it says 80% of wealth is held by 20% of people. In computing, it says fixing 20% of bugs 80% of issues will be fixed. In sports, 20% of exercises has 80% effect. It’s also called the law of vital few. You can refer more here: https://en.wikipedia.org/wiki/Pareto_principle

Pareto effect on investing: You may invest in 100 different places but the wealth generated will be from 20 of them only. So there is actually no point in diversifying and investing in 100 different places. You should concentrate more on that 20% of quality investments to generate maximum returns.

Last day I happened to read about a person who strictly follows this principle and had invested all his savings in 3 different companies. To my disbelief, those 3 shares have generated more than 100% return this year itself. Nope, I won’t name those as those are based on his personal research and I don’t want to be biased.

After reading his story I checked out my stock portfolio and it does reflect the same on my stocks too. Diversification is the key but don’t be over diversified to run into negative returns.

A very related and common mistake that I found with diversification is not investing enough. Suppose a person has 10lakhs in shares and as a part of diversification he invests Rs. 10,000/- in shares of a company C. After a couple of years the value of the shares might have doubled and become 20,000 but that 20,000 is just 2% of his total investments. So while investing ensure you have the right mix of diversification.

Leave a Reply